Ideal Info About How To Lower Property Tax In California

Applying for a property tax exemption in california.

How to lower property tax in california. California mortgage relief program and property tax assistance. The best way to reduce property taxes in california is to apply for one of the following property tax exemptions: Ask the tax man what steps you need to take in order to appeal your current bill.

Another way to lower your property taxes is to take advantage of exemptions and tax breaks. Try lowering your california property taxes by filing an appeal with your county's tax assessor. By reducing the assessed value by $7,000, your yearly taxes are reduced up to $70.

The appeal process is complicated. Exemptions of $7,000 are available to california real estate owners. Contact your local tax office.

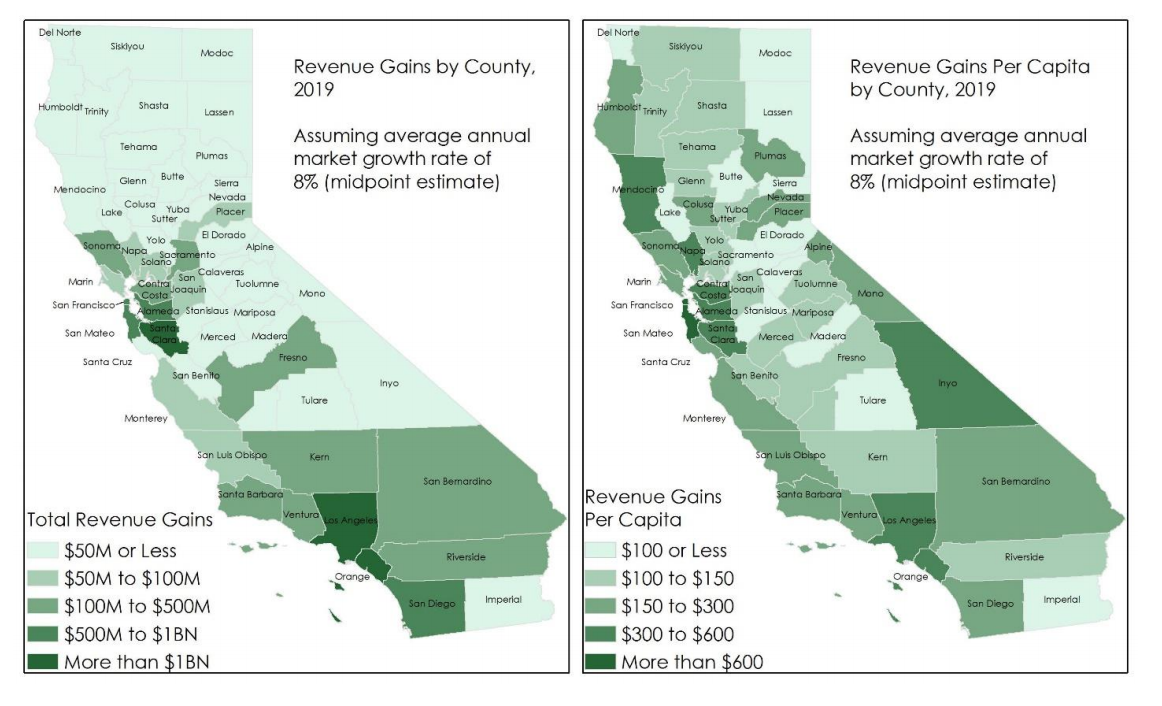

$1 billion in mortgage relief funds are now available to california homeowners who have fallen behind on housing. Many counties offer payment plans for nonprofits. The boe acts in an oversight capacity to ensure compliance by county assessors with property tax laws, regulations, and assessment issues.

By the time you are already paying a certain amount, it's. Homeowners over the age of 55, for example, may qualify for the senior citizens’. To lower your property taxes in a few clicks, log in to donotpay and follow these steps:

This process is referred to as income splitting. Another way to reduce the property tax burden for nonprofits is to negotiate a payment plan with the county tax assessor. This video covers how property tax is calculated and how you can pay a lower overall property tax.

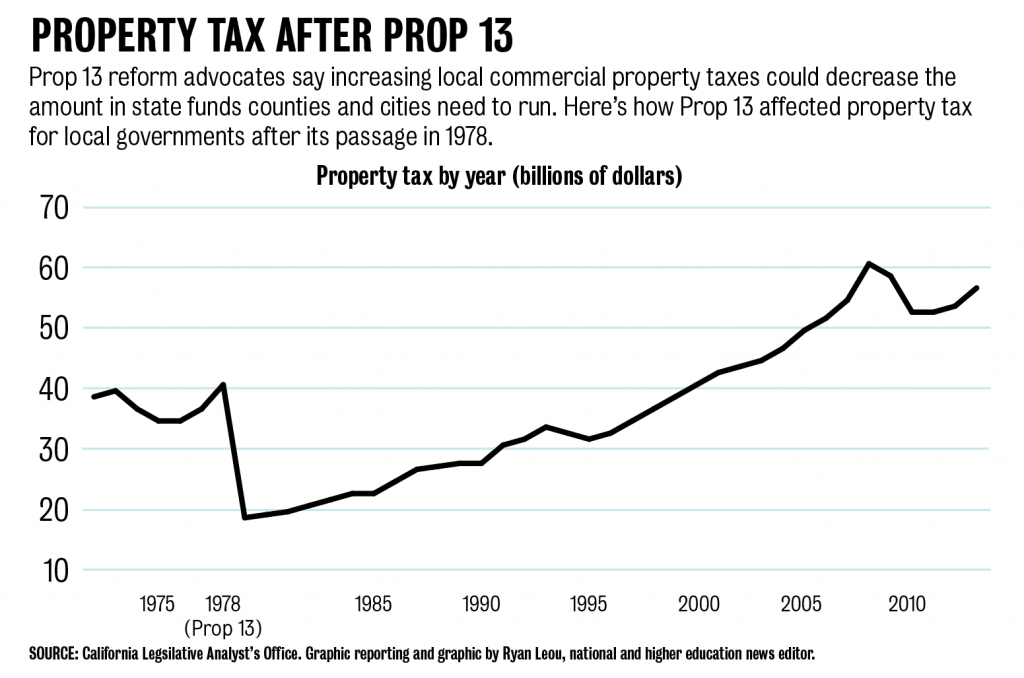

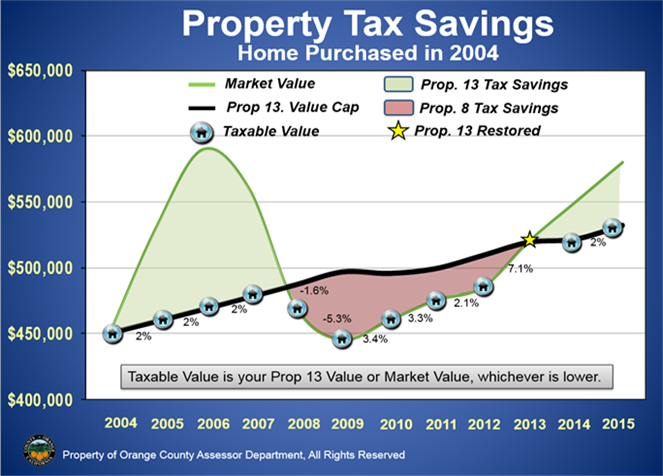

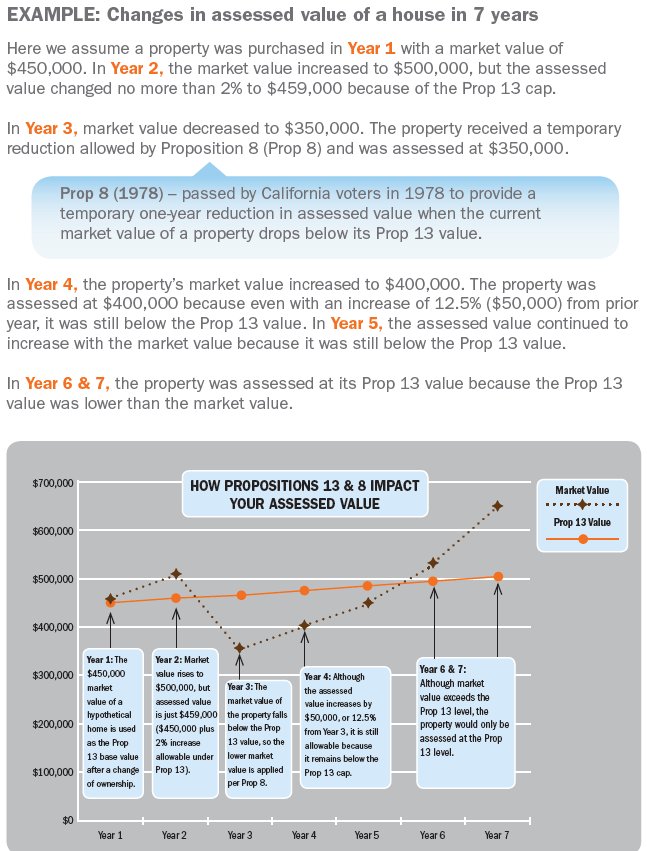

As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in other words, by. Property value declining is the number one reason that california property tax appeals are filed each and every year. Property value is only assessed when the ownership of.

A property tax calculator is an incredibly powerful tool. Property taxes are calculated by multiplying your municipality's effective tax rate by the most recent assessment of your property. How can i lower my property taxes in california?

Appeal the taxable value of your home. As shown in “box a” of the sample property tax bill in figure 1, this exemption lowers the assessed value of the homeowner’s land and improvements by $7,000, reducing. Make sure you review your tax card and look.

With just a few clicks, you can find out how much you’ll pay in property taxes. Homeowners exemption, senior citizens exemption, veterans exemption,. Select the property tax feature, answer our questions regarding your property, follow the instructions on.