Supreme Info About How To Find Out Your Adjusted Gross Income For 2007

It will always be adjusted for credits and deductions and will be lower than your gross annual.

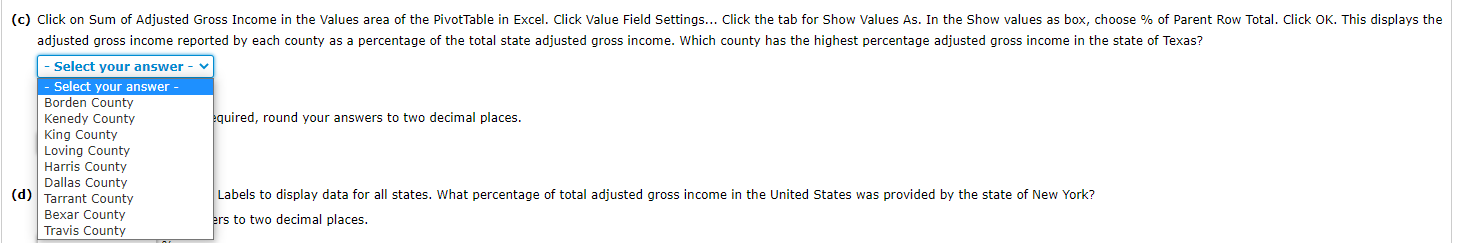

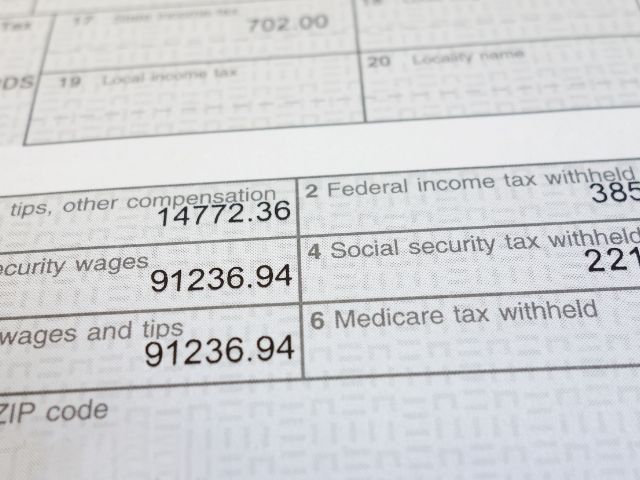

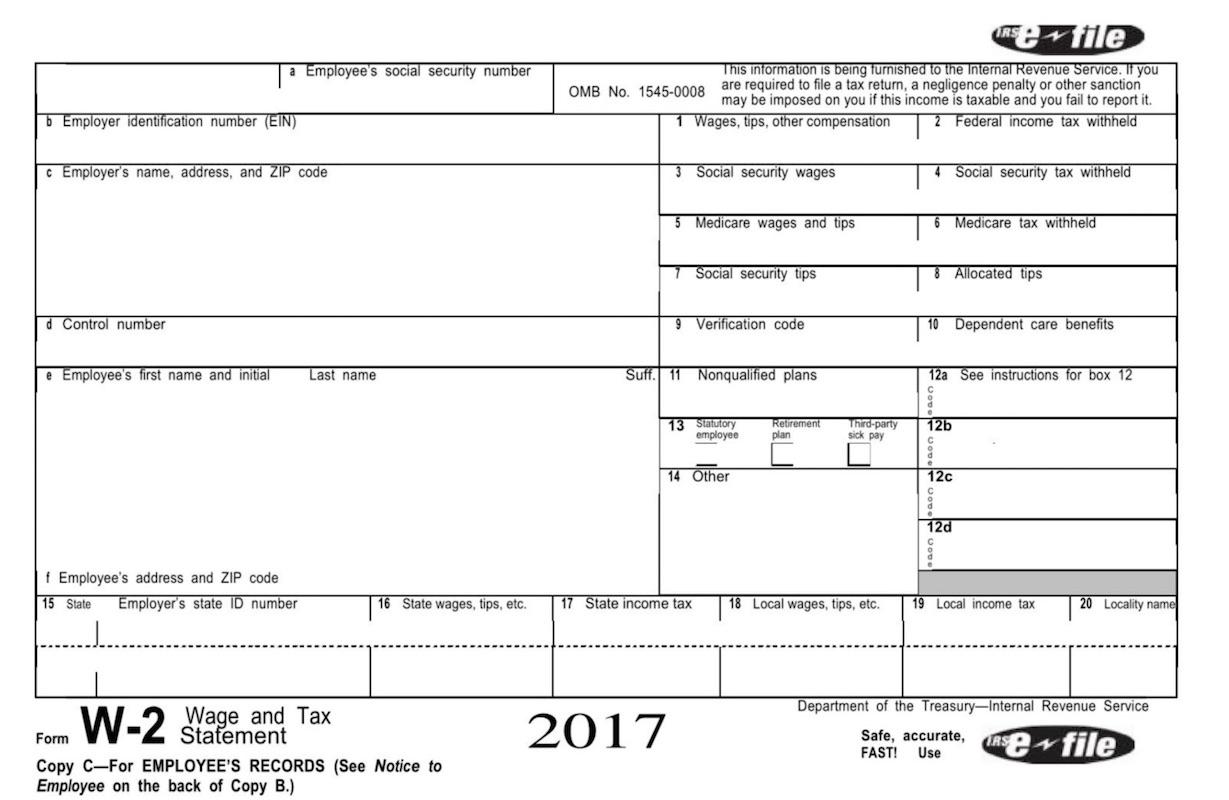

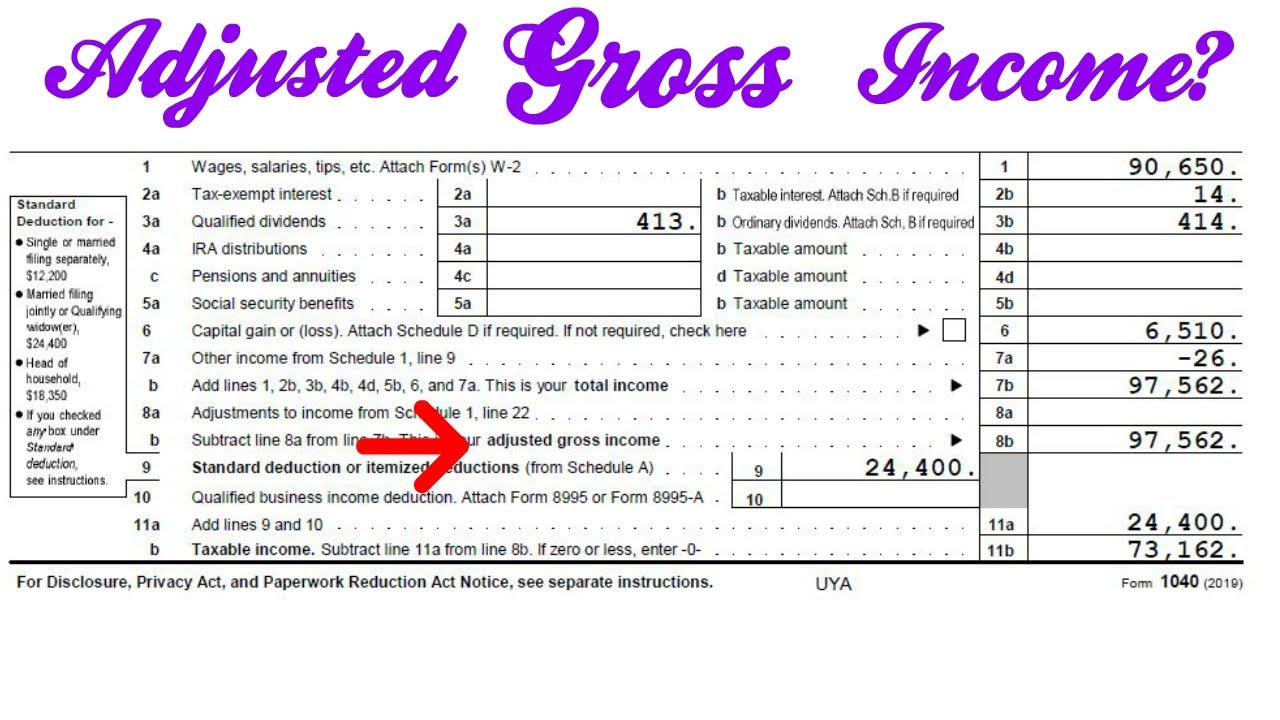

How to find out your adjusted gross income for 2007. All topics topic money & services taxes » 2007 gross adjusted income lawnor posts: Adjusted gross income in a nutshell. Your agi can be found on line 11 of irs form 1040 and in your additional income and adjustments to income on schedule 1 form 1040.

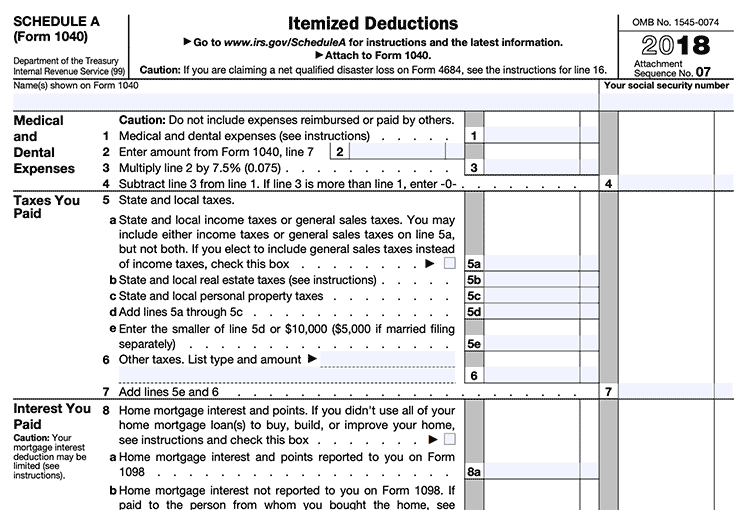

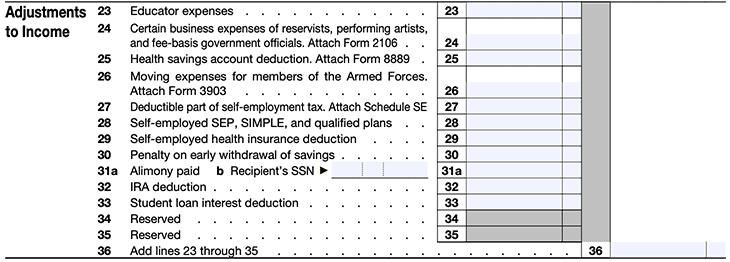

You need to use part ii on schedule 1 to tally the adjustments to income that apply to you. Magi, in most cases is simply your adjusted gross income plus taxable interest found on lines 37 and 8b of your irs from 1040. your gross income includes your wages.

Subtract your deductions from your total annual income. You can find these adjustments on schedule 1 of form 1040, under “part ii —. Now that you have your total annual income and the total amount of your deductions, subtract your deductions from.

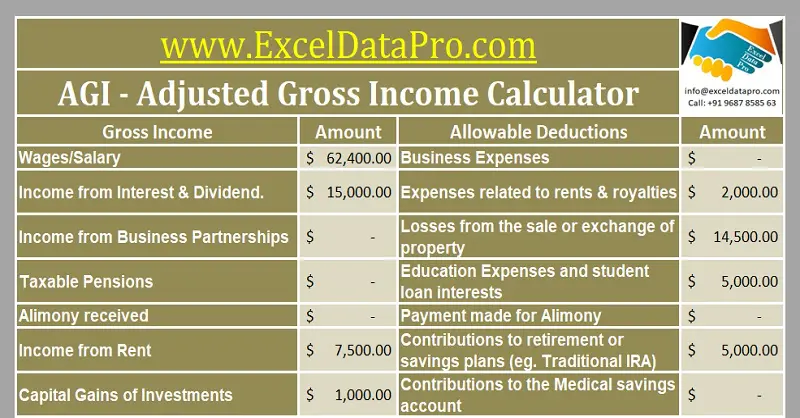

That number includes your salary, dividends, rental income and any other income you had come in during the year. Your adjusted gross income is your gross income on your w2 minus your major deductions for the year. To do your agi calculation, you will need to determine your total gross income for the year.

You can calculate your agi for the year using the following formula: Where you can actually find your adjusted gross income is on the full tax return that you submit to the irs. This decreases your taxable income, which can have an impact on.

Your adjusted gross income is simply your total gross income minus certain adjustments. How to calculate adjusted gross income (agi)? How do you calculate gross income on tax return?

If you prepare your own taxes, you will need to calculate your agi to report to the irs. How do you calculate your adjusted gross income? You can locate your prior year adjusted gross income by looking at.

Take a look at the form. Feb 20, 2009, 08:41 am 2007 gross adjusted income. • your adjusted gross income (agi) consists of the total amount of income and.

First, you need to calculate your gross income. Remember, your adjusted gross income cannot exceed the total income you earn in a tax year. The agi calculation is relatively straightforward.

Follow these steps to quickly determine your agi: Adjusted gross income (agi) also starts out as gross income, but before any taxes are paid, gross income is reduced by certain adjustments allowed by the internal revenue.